Building a Stronger Institution: Strategic Portfolio Review

Shifting demographics, increasing competition, and budgetary pressures highlight the importance of establishing a proactive, data-driven approach to examining an institution’s overall academic portfolio as well as individual programs within the portfolio.

Offering the right suite of programs positions colleges and universities to grow enrollment, to make effective use of limited resources, and to strengthen their brand.

This article, the first in the series on optimizing your program offerings, recommends starting with a review of your academic portfolio to understand the strength of your overall suite of programs.

What is a portfolio review?

Portfolio review refers to an evaluation of a suite of programs offered by an institution. The scope of a portfolio review may include all of the institution’s programs or a subset of programs, such as master’s programs or online programs.

A portfolio review uses a set of agreed-upon metrics to provide a snapshot of the program mix and performance to inform institutional strategic planning, resource allocation, and alignment with institutional mission. Optimizing program offerings starts with a portfolio review, which can help identify specific programs for deeper examination.

A benchmark for review frequency

Many institutions have a long-standing program review cycle for examining individual programs, often once every five to seven years. The process is typically faculty-led and involves individual academic departments conducting an in-depth self-study of the program under review.

This traditional program review process cannot provide institutional leaders the real-time insights they need to make strategic decisions in today’s rapidly evolving market.

Reviewing programs every two to three years is a good benchmark. Establishing a program review process that takes into account external market conditions, internal program data, institutional goals, and a timely review process is critical for sustaining a viable portfolio of academic programs.

How to conduct a holistic portfolio review

Conducting a high-level review of an academic portfolio before delving into the specifics of an individual program is crucial for gaining a comprehensive understanding of an institution’s overarching goals, strengths, and areas for improvement.

By examining the broader spectrum of academic offerings, administrative structures, and institutional priorities, stakeholders can identify patterns, trends, and disparities that may influence decision-making at the program level. This holistic approach enables administrators to contextualize the performance of individual programs within the broader institutional framework, fostering a more informed and strategic approach to academic planning and resource allocation.

Furthermore, starting with a review of the academic portfolio promotes transparency, accountability, and equity within the institution. It allows for an inclusive assessment process that considers the diverse needs, perspectives, and contributions of various academic departments, disciplines, and stakeholders.

Categorizing your programs

The first step is to categorize programs based on a national view of program size and growth trends. This analysis provides a snapshot of the program mix to identify individual programs for further analysis.

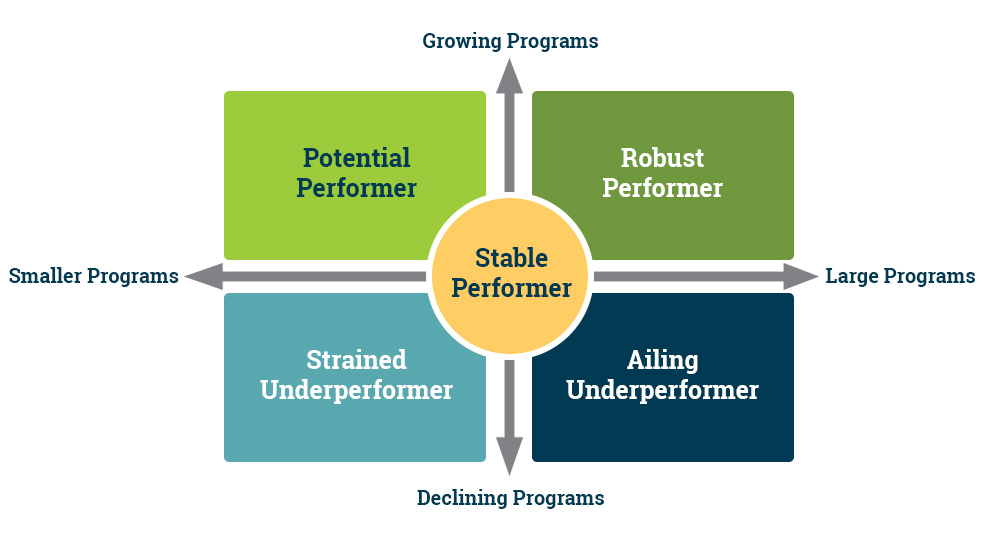

Figure 1: Portfolio Growth Segments

Here’s how we define growth segments:

- Robust Performer: Large and growing programs, considered good prospects for driving growth

- Potential Performer: Small but growing programs that have the potential to become robust if they can scale

- Stable Performer: Often large, commoditized legacy programs with stagnant growth

- Strained Underperformer: Small programs with declining enrollment where growth is limited

- Ailing Performer: Large programs with declining enrollment, determine whether a program refresh may turn the dial

Institutions should strive to achieve a balanced portfolio that prioritizes segments with growth and volume (Robust and Stable). Forward-looking schools dedicate some budget and resources to testing emerging programs (Potential). Strained and Ailing programs should be limited to those deeply aligned to the institution’s mission or a strong regional need.

The table below is an example of an institution’s portfolio review showing how its programs align with these growth segments and institutional data: conferrals, the 1-year growth trend, and 5-year growth trend. It illustrates the right mix of growth segments in a nicely balanced portfolio.

Next steps for portfolio management

Once you’ve completed this assessment, you have powerful data to inform strategic planning. The resulting categories highlight opportunities for better managing your portfolio and suggesting areas for potential shifts in budget, scaling up, or additional data analysis. For example, begin by further investigating programs classified as Robust Performers. Optimizing these programs typically provides a relatively quick return on investment.

- Robust Performers: Maintain strength in this segment and increase market share with ongoing investment.

- Potential Performers: Identify specific programs with realistic growth potential based on regional market factors.

- Stable Performers: Analyze programs to determine alignment with institutional priorities and streamline those misaligned. Innovative approaches are required to maintain market share.

- Strained Underperformers: Seek to “right size” number of programs with conferrals and divest in those without growth potential.

- Ailing Underperformers: Assess future viability of programs in decline and shift resources to Robust Performers.

Recommendations for the most meaningful results

The point of a portfolio review is to look at the holistic picture of your program offerings. Often the best way to achieve this data-driven assessment is to partner with an objective third party or identify a neutral internal party who is able to review data from multiple angles beyond academics.

The next article in this series will offer recommendations for using internal and external data for individual program evaluation. In the meantime, contact us to discuss how we can help you conduct a comprehensive portfolio review.

Innovation Starts Here

Higher ed is evolving — don’t get left behind. Explore how Collegis can help your institution thrive.