In today’s competitive higher education landscape, institutions can no longer afford to rely on instinct alone when it comes to academic program planning. The stakes are too high and the margin for error too slim.

Leaders are facing increasing pressure to align their portfolios with market demand, institutional mission, and student expectations — all while navigating constrained resources and shifting demographics.

The good news? You don’t have to guess. Market intelligence offers a smarter, more strategic foundation for building and refining your academic program mix.

Why program optimization matters now more than ever

Most institutions have at least one program that’s no longer pulling its weight — whether due to declining enrollment, outdated relevance, or oversaturated competition. At the same time, there are often untapped opportunities for growth in emerging or underserved fields.

But how do you decide which programs to scale, sustain, or sunset?

Optimizing your portfolio requires more than internal performance metrics. It calls for an external lens — one that brings into view national and regional trends, labor market signals, and consumer behavior. When done effectively, academic portfolio strategy becomes less about trial and error, and more about clarity and confidence.

The first step: Start with the market

The strongest portfolio strategies begin with robust external data. At Collegis Education, we draw from sources like the National Center for Education Statistics (IPEDS), Lightcast labor market analytics, and Google search trends to assess program performance, student demand, and employment outlooks.

National trends give us the big picture and a foundation to start from. But for our partners, we prioritize regional analysis — because institutions ultimately compete and serve in specific geographic contexts, even with fully online programs. Understanding what’s growing in your state or region is often more actionable than knowing what’s growing nationwide.

Our proprietary methodology filters for:

- Five-year conferral growth with positive year-over-year trends

- Programs offered by a sufficient number of institutions (to avoid anomalies)

- Competitive dynamics and saturation thresholds

- Job postings and projected employment growth

This data-driven process helps institutions avoid chasing short-term trends and instead focus on sustainable growth areas.

Ready for a Smarter Way Forward?

Higher ed is hard — but you don’t have to figure it out alone. We can help you transform challenges into opportunities.

Data in action: Insights from today’s growth programs

Collegis’ latest program growth analyses — drawing from 2023 conferral data — surface a diverse mix of high-opportunity programs. While we won’t detail every entry here, a few trends stand out:

- Technology and healthcare programs remain strong at the undergraduate level, with degrees like Computer Science and Health Sciences showing continued growth.

- Graduate credentials in education and nursing reflect both workforce need and strong student interest.

- Laddering potential is especially evident in fields like psychology and health sciences, where institutions can design seamless transitions from associate to bachelor’s. In fields such as education, options to ladder from certificate to master’s programs are growing in demand.

What’s most important isn’t the specific programs, it’s what they reveal: external data can confirm intuition, challenge assumptions, and unlock new strategic direction. And when paired with regional insights, these findings become even more powerful.

How to turn insight into strategy

Having market data is just the beginning. The true value lies in how institutions use it. At Collegis, we help our partners translate insight into action through a structured portfolio development process that includes the following:

- Market analysis: Analyzing external data to identify growth areas, saturation risks, and demand signals — regionally and nationally.

- Gap analysis: Identifying misalignments between current offerings and market opportunity.

- Institutional alignment: Layering in internal metrics — enrollment, outcomes, mission fit, modality, and margin.

- Strategic decisions: Prioritizing programs to expand, launch, refine, or sunset.

- Implementation support: Developing go-to-market plans, supporting change management, and measuring results.

By grounding these decisions in both internal and external intelligence, institutions can future-proof their portfolios — driving enrollment, meeting workforce needs, and staying mission-aligned.

Put data to work for your portfolio

Program portfolio strategy doesn’t have to be a guessing game. With the right data and a trusted partner, institutions can make bold, confident moves that fuel growth and student success.

Whether you’re validating your instincts or exploring new academic directions, Collegis can help. Our market research and portfolio development services are built to support institutions at every step of the process — with national insights and regional specificity to guide your next move.

Innovation Starts Here

Higher ed is evolving — don’t get left behind. Explore how Collegis can help your institution thrive.

Report Title: Building a Better Pipeline: Enrollment Funnel Needs and Perspectives from Potential Post Baccalaureate Students

Author: Collegis Education + UPCEA

Published: December 2024

Who should read:

- Presidents

- Provosts

- Marketing leaders

- Enrollment leader

Key points addressed

In this ebook, you’ll learn more about prospective graduate students’ needs and expectations as they move through the enrollment funnel, including:

- The level of degree desired, as well as the preferred learning format

- Factors that cause disengagement during the inquiry and application processes

- Prospective students’ communication preferences and application expectations

- How institutions can tailor recruitment strategies accordingly

Overview

While higher education institutions face tightening budgets, demographic cliffs, and other market headwinds, many schools see graduate enrollment growth as a critical strategy despite the increasingly competitive landscape. Strategic investments in outreach have never been more vital.

With more and more programs sharing similarities in their structure than differences, one way schools can win is by delivering frictionless and exceptional student experiences, using prospective graduate students’ preferences, behaviors, and other insights to personalize engagements and outreach.

By understanding these preferences, institutions can better tailor their recruitment strategies and allocate resources more effectively in an increasingly competitive landscape., and recommendations for technology investments to improve student success.

Download Now

Transform Challenges Into Opportunities

Facing challenges in enrollment, retention, or tech integration? Seeking growth in new markets? Our strategic insights pave a clear path for overcoming obstacles and driving success in higher education.

Unlock the transformative potential within your institution – partner with us to turn today’s roadblocks into tomorrow’s achievements. Let’s chat.

As a higher education leader, it’s no secret that you’re facing a fiercely competitive graduate enrollment landscape. You know as well as I do that understanding what prospective students want and how they behave isn’t just helpful – it’s crucial to your institution’s success. That’s why we teamed up with UPCEA to conduct a deep dive into today’s post-baccalaureate students, uncovering their unique needs, expectations, and wants.

We’ve published those insights in our latest report to help colleges and universities fine-tune their graduate enrollment strategies and deliver real results. You can download the complete report here: “Building a Better Pipeline: Enrollment Funnel Needs and Perspectives from Potential Post-Baccalaureate Students“

Our research focused on individuals who expressed at least some interest in pursuing advanced education, and this study sheds light on what matters most to potential graduate students—everything from program types and communication preferences to application expectations.

As we dug into the data, some obvious themes emerged. Here are five key findings that can prepare your institution to stand out in this tight market and guide you in shaping strategies that resonate, engage, and deliver results.

5 insights to sharpen your graduate enrollment strategy

1. Graduate enrollment is a crowded market—and the stakes are high

This is no surprise to those working in higher ed in recent years. Graduate enrollment is slowing, with just a 1.1% projected increase over the next five years. Adding to the challenge, 20% of institutions dominate 77% of the market. For everyone else, it’s a fierce battle for a shrinking pool of candidates. To win, you’ll need a sharp, focused approach.

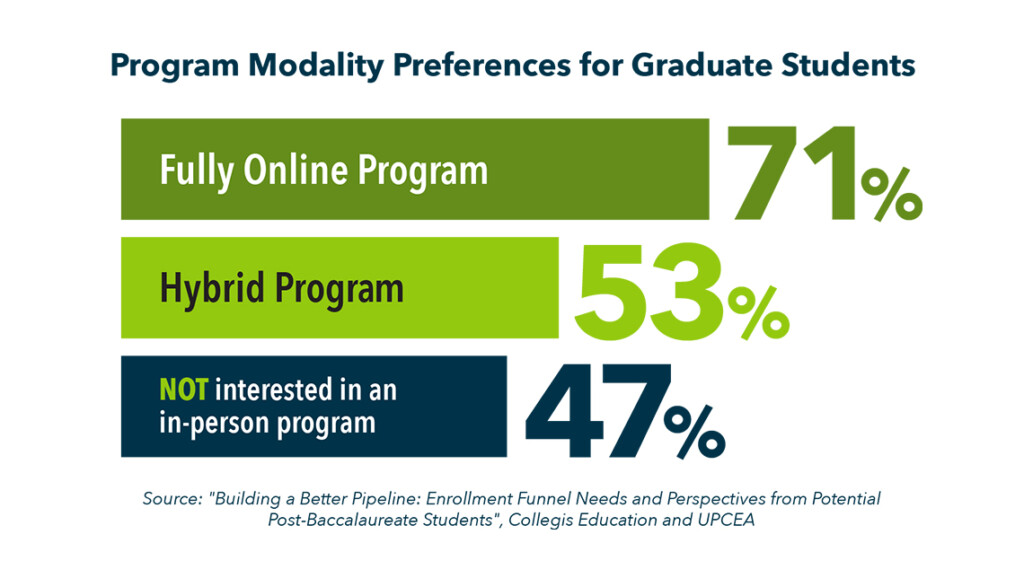

2. Online programs are the clear favorite

Did you know that 71% of prospective students are “extremely” or “very” interested in fully online programs? Hybrid formats come in a close second, while traditional in-person options are struggling to keep pace. The data confirms that flexibility isn’t a trend—it’s a necessity.

3. Program information is a make-or-break factor

Here’s something we see far too often: quality programs losing prospective students simply because critical details—like tuition costs and course requirements—are buried or missing entirely from the school’s website. In fact, 62% of students indicated they would drop off early in their search for this exact reason.

The fix? It’s simpler than you might think. By optimizing your program pages and doubling down on SEO, you can turn passive visitors into engaged prospects.

4. Financial transparency builds trust

Sticker shock is real. High application fees, vague cost information, and limited financial aid details are among the top reasons students abandon the application process late in the game. By addressing these concerns clearly and directly, you’re not just solving a problem, you’re building trust.

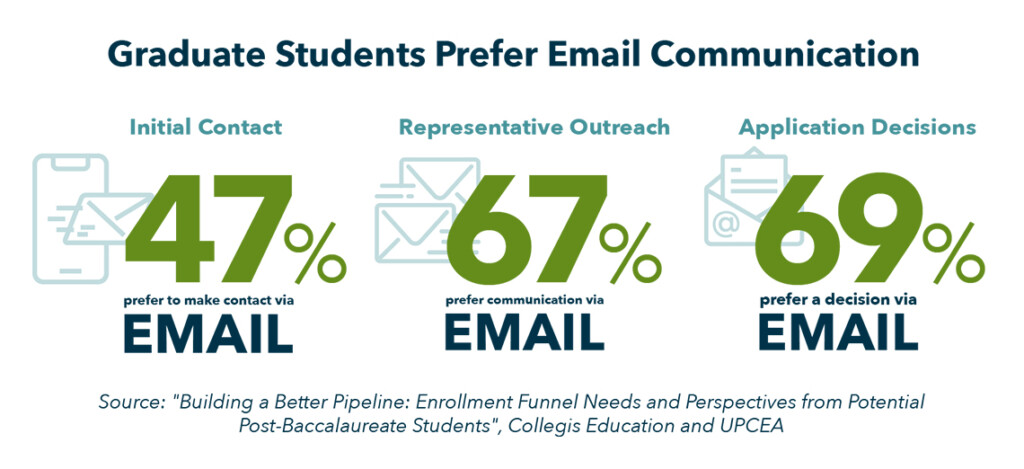

5. Email is still king

When it comes to connecting with prospective graduate students, email reigns supreme. Whether it’s inquiring about programs (47%), application follow-ups (67%), or receiving application decisions (69%), email is the channel students trust the most.

But here’s the catch: your emails have to be timely, personalized, and relevant in order to make an impact.

The key to graduate enrollment success is just a click away

The insights highlighted above are just the tip of the iceberg. Imagine what’s possible when you apply them to your graduate enrollment strategy.

If you’re ready to refine your approach and stay ahead of the curve, we’ve got you covered. Our report dives deeper into the data and uncovers actionable insights, including:

- Positioning your online and hybrid offerings to meet growing demand

- Optimizing program pages to emphasize the information students value most

- Communicating financial information proactively to convert candidates

- Building email outreach strategies that build trust and keep students engaged

Grab your complimentary copy of the report today, and let’s start building a better pipeline together!

Your roadmap to winning in the competitive graduate market.

Optimize Your Enrollment Funnel

Get the latest data on graduate student enrollment trends. Download the full report now.

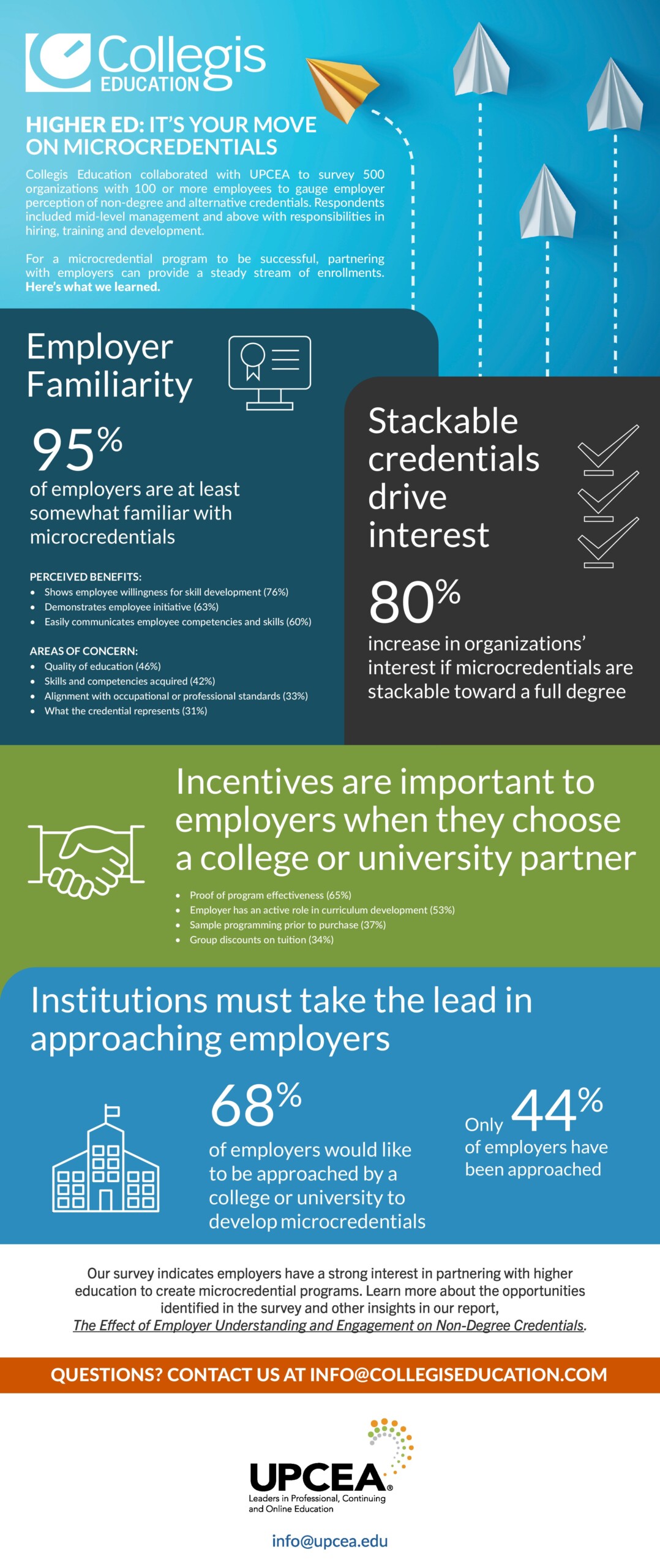

As demand for skills-based learning grows, microcredentials are emerging as a key opportunity for higher education institutions to strengthen employer partnerships. But what do businesses actually look for in these programs, and how can colleges and universities position themselves as the preferred partner?

To find out, Collegis Education and UPCEA surveyed 500 organizations to gauge employer perceptions of non-degree credentials. Here’s a snapshot of what we found:

To capitalize on the growing demand for microcredentials, institutions must proactively engage employers with well-designed, industry-aligned programs. By addressing employer concerns and offering flexible, high-value learning pathways, colleges and universities can establish long-term workforce partnerships and create sustainable enrollment pipelines.

The insights found in the infographic only scratch the surface of what the research uncovered. Download the full report to learn what incentivizes employers to work with four-year higher ed schools.

Unlock Employer Insights

Learn what businesses seek in higher ed partnerships. Download the report today.

As the demand for workforce upskilling grows, higher education institutions have a unique opportunity to partner with employers on microcredentials and professional development programs. But with increasing competition from private providers like LinkedIn Learning, Coursera, and Khan Academy, how can colleges and universities stand out?

To answer this question, Collegis Education and UPCEA surveyed more than 500 employers to understand their perceptions of working with higher ed institutions on professional development and alternative credentials.

Here’s a snapshot of what we found:

To stand out, institutions must focus on affordable, practical, and well-structured programs that align with employer needs. Successful partnerships require responsive engagement, clear outcomes, and content that directly applies to the workplace.

The insights found in the infographic only scratch the surface of what the research uncovered. Download the full report to learn what incentivizes employers to work with four-year higher ed schools.

Unlock Employer Insights

Learn what businesses seek in higher ed partnerships. Download the report today.

In our recent blog series, we’ve discussed how to review your school’s academic portfolio and evaluate individual programs. Colleges and universities must continually consider their mix of programs and carefully select new programs to remain relevant to the needs of students, employers, and society.

Institutions increase the likelihood that new programs will thrive by considering complex data sets, including market demand, competition, and financial projections. This data-driven decision making provides the basis for realistic expectations on investments and returns.

Let’s look at recommended data sources.

Identifying workforce needs through market analysis

An analysis of the demand for specific degrees, skills, or disciplines can identify emerging trends, regional workforce needs, and areas of anticipated job growth in the region, which provides a solid foundation for identifying potential program offerings.

By examining a combination of labor market trends, employment projections, and occupational outlooks, colleges and universities can gain valuable insights into areas of growth and demand for skilled professionals.

Data sources may include the following:

- Government agencies, such as the Bureau of Labor Statistics (BLS)

- Job posting and recruitment platforms, which aggregate data on job postings and offer real-time information about the skills and qualifications employers are seeking

- Labor market analytics tools that use big data and machine-learning algorithms to analyze job market trends, skills demand, and salary data

Understanding student needs and aligning programs with demand

Understanding student needs and preferences is essential for designing programs that resonate with the target audience. Assess student needs by:

- Analyzing enrollment data and trends within existing programs

- Gathering data from your enrollment management team about what prospective students are looking for

- Reviewing Google search trends for insights into student demand outside of the institution

- Analyzing enrollment and completion data from regional competitors

Differentiating your offerings through competitive program analysis

Understanding the competitive landscape is equally important. Identifying programs offered by your competitors — their structure, cost, and delivery — and then comparing that data to your market analysis will provide insights into what competitors are offering and highlight areas of opportunity for differentiating your programs.

By aligning new offerings with student aspirations and career goals, universities can attract and retain a diverse and engaged student body. This can further inform decisions about where to invest resources for new program development.

Securing program sustainability: Financial viability and resource allocation

Financial considerations should play a substantial role in the analysis of new program opportunities. A thorough financial analysis should assess the potential costs, revenue streams, and return on investment associated with launching and sustaining new programs.

Identify resource requirements, including faculty, staff, facilities, technology, marketing, recruitment, retention, and administrative support, to ensure the institution can adequately support the proposed programs.

The uncertainty in the shifting higher education market should be built into financial forecasting. Additionally, flexibility to adjust based on actual performance is necessary. Institutions are well advised to develop a multi-year pro forma that establishes realistic revenues, costs, and ROI timelines based on market conditions.

Leveraging institutional strengths and brand for program development

New academic programs should align closely with the mission, values, and strategic priorities of the institution. Institutions should leverage their existing academic strengths, faculty expertise, resources, and brand when considering new programs.

By building on established areas of excellence and reputation, colleges and universities can create innovative and competitive programs that set them apart in the higher education landscape. New offerings must complement and enhance the academic portfolio of the institution and build on the institutional reputation.

Industry partnerships and engagement

Leveraging relationships with employers and industry associations in the region will provide important insights into workforce needs. Additionally, advisory boards composed of employers who can provide firsthand perspective on workforce realities are a valuable source of insight for developing in-demand programs.

Major employers and associations can provide information about program naming, program outcomes, curricula, marketing channels, and degree levels (associate, bachelors, masters, certificate). These relationships also help you reach your intendent audience and build pathways for internships, hiring opportunities, and program instructor resources.

Continuous program evaluation and adaptation

To maintain a healthy portfolio of programs, the selection of new academic programs must be accompanied by timely and continuous program evaluation and adaptation. Regular monitoring of performance based on agreed-upon metrics will provide decision makers with the information necessary to make data-driven decisions.

Those metrics should include enrollment trends, student outcomes, alumni success, employer feedback, financial performance, and other relevant measures of program success. Flexibility and agility are essential for responding to evolving market demands, technological advancements, and changes in student needs.

Crafting the future

Innovative and sustainable programs that support the institutional mission are essential to a healthy, balanced portfolio. Selecting new academic programs requires a combination of strategy, discipline, and process informed by multiple relevant and current data sources. With careful planning and execution, universities can navigate the path to success and ensure their academic programs remain relevant, impactful, and sustainable in the years to come.

Adopting this culture of continual review and reflection can be challenging. Collegis can provide an objective assessment of your new program opportunities and give you the tools you need to future-proof your academic portfolio. Contact us to get started.

Innovation Starts Here

Higher ed is evolving — don’t get left behind. Explore how Collegis can help your institution thrive.

The first blog in this program strategy series addressed the difference between assessing a portfolio of programs and conducting an individual program analysis. In that article, we recommended a high-level assessment of a suite of academic programs to understand your portfolio’s strength and highlight opportunities for better management. The next step in the process is to conduct a more targeted academic review.

In today’s rapidly evolving higher ed landscape, colleges and universities face mounting pressures to stay relevant and responsive to the needs of students and employers alike. With the job market becoming increasingly competitive and industries undergoing constant transformations, academic institutions need to adopt a market-driven approach to reviewing academic programs. Considering a variety of market factors helps ensure that academic offerings align closely with industry demands and student aspirations, fostering greater success for both graduates and the institutions themselves.

Introduction to academic program review

At most institutions, the program review process traditionally occurs once every five to seven years and typically includes:

- An in-depth self-study led by program faculty involving program administrators and students,

- A review of the self-study report by a team outside of the department housing the program, and

- Determination of next steps based on program review findings.

This approach focuses primarily with an internal lens, considering factors such as enrollment trends, curriculum coherence, faculty expertise, and student and graduate outcomes.

While these aspects remain essential, supplementing the traditional five-year review cycle with a more frequent, market-driven approach to program evaluation and resource allocation can help institutions adapt swiftly to changing workforce needs and technological advancements.

The role of market data in academic decision-making

The market-driven approach provides three key benefits.

Enhances the employability of graduates

By analyzing industry trends, job market demands, and employer feedback, institutions can tailor the curricula of their academic programs to equip students with the skills and knowledge most valued by employers.

This proactive approach not only increases students’ chances of securing meaningful employment but also enhances the reputation of the institution as a provider of career-ready graduates.

Fosters innovation and agility within academic institutions

By closely monitoring market trends and emerging fields, schools can introduce new programs or modify existing ones to address emerging needs. This flexibility enables institutions to stay ahead of the curve, offering cutting-edge education that prepares students for the jobs of tomorrow.

Enhances partnerships and collaboration with industry stakeholders

By actively engaging with employers, professional associations, and community organizations, universities can gain valuable insights into industry expectations and cultivate opportunities for internships, co-op programs, and applied research projects.

These partnerships not only enrich the learning experience for students but also provide avenues for faculty professional development and research funding.

How to prioritize program analysis

Start with programs classified as Robust Performers, those that are large and growing (see the first blog in the series for details). These programs are more likely to have a shorter timeline for realizing a return on investment.

With the exception of mega-universities (such as Southern New Hampshire, WGU, Grand Canyon, and ASU), college and university enrollment is regionally focused. Students gravitate toward familiar brands, and research continues to show they prefer institutions within 50 miles of their home. Therefore, we recommend, when possible, focusing on regional, external data in program analysis.

Adult learner audiences

Many institutions today are focused on aligning programs to successfully reach the adult learner population.

The snapshot below provides an overview of the fundamental aspects of program design necessary to attract these learners. A comprehensive academic program review should include an evaluation of the program’s alignment with each of these factors.

Affordability

- Cost: competitive to regional providers

- Generous transfer credits

More relevance

- Career relevant

- Employer-recognized credentials

- Stackable pathways

Fewer barriers

- 3-6 start terms

- No entry exams

- “Level-up” course options

- Minimal transcript requirements

- No deposit fees

Flexibility

- Online

- Low/zero residency

- Asynchronous delivery

- “Stop out” re-entry support

- Terms of 6–8 weeks

Metrics for evaluating program demand

In a market-driven approach to program review, it’s crucial to gather and analyze relevant data points that reflect the demands and trends of the job market and industry sectors. Here are some key data points to consider:

- Labor market analysis:

- Employment trends in relevant industries or sectors

- Projected growth or decline in specific occupations

- Regional demand for certain skills or professions

- Industry surveys and feedback:

- Surveys or interviews with employers to identify desired skills and competencies

- Feedback from alumni regarding the relevance of their education to their careers

- Input from professional associations or industry partners on emerging trends and technologies

- Competitors: Enrollment and conferral trends of regional competitors offering similar programs

- Student demand: Key search volume and estimation of inquiry volume (Google search data is often used as a proxy for student demand as well as data from enrollment on what prospective students are looking for)

- Job placement and career outcomes:

- Employment rates and job placement statistics for program graduates

- Average starting salaries and career progression data

- Employer satisfaction with the skills and preparedness of graduates

- Skills and competency mapping:

- Identification of key skills and competencies required for success in relevant fields

- Alignment of program learning outcomes with industry needs and professional standards

- Assessment of student proficiency in critical areas through surveys, assessments, or employer feedback

- Graduate feedback and alumni success:

- Surveys or interviews with program graduates to assess the relevance of their education to their careers

- Tracking of alumni achievements, leadership positions, and contributions to their fields

- Alumni networking events or mentorship programs to foster ongoing engagement and feedback

Tap a partner for job market insights

Collecting this important market data every two to three years may require assistance from an external agency well-versed in collecting and analyzing the data.

When selecting a partner, it’s important to consider their expertise and experience working with higher education programs, knowledge of the institution, and access to analytical tools (such as Collegis Education’s exclusive collaboration with Google Cloud).

Insights into the evolving needs of the market allow academic institutions to make informed decisions that enhance the relevance, quality, and impact of their programs. This market-driven approach ensures that graduates are well-equipped to meet the demands of the workforce and contribute meaningfully to their chosen professions and industries. And that reflects well on the institution.

Innovation Starts Here

Higher ed is evolving — don’t get left behind. Explore how Collegis can help your institution thrive.

Shifting demographics, increasing competition, and budgetary pressures highlight the importance of establishing a proactive, data-driven approach to examining an institution’s overall academic portfolio as well as individual programs within the portfolio.

Offering the right suite of programs positions colleges and universities to grow enrollment, to make effective use of limited resources, and to strengthen their brand.

This article, the first in the series on optimizing your program offerings, recommends starting with a review of your academic portfolio to understand the strength of your overall suite of programs.

What is a portfolio review?

Portfolio review refers to an evaluation of a suite of programs offered by an institution. The scope of a portfolio review may include all of the institution’s programs or a subset of programs, such as master’s programs or online programs.

A portfolio review uses a set of agreed-upon metrics to provide a snapshot of the program mix and performance to inform institutional strategic planning, resource allocation, and alignment with institutional mission. Optimizing program offerings starts with a portfolio review, which can help identify specific programs for deeper examination.

A benchmark for review frequency

Many institutions have a long-standing program review cycle for examining individual programs, often once every five to seven years. The process is typically faculty-led and involves individual academic departments conducting an in-depth self-study of the program under review.

This traditional program review process cannot provide institutional leaders the real-time insights they need to make strategic decisions in today’s rapidly evolving market.

Reviewing programs every two to three years is a good benchmark. Establishing a program review process that takes into account external market conditions, internal program data, institutional goals, and a timely review process is critical for sustaining a viable portfolio of academic programs.

How to conduct a holistic portfolio review

Conducting a high-level review of an academic portfolio before delving into the specifics of an individual program is crucial for gaining a comprehensive understanding of an institution’s overarching goals, strengths, and areas for improvement.

By examining the broader spectrum of academic offerings, administrative structures, and institutional priorities, stakeholders can identify patterns, trends, and disparities that may influence decision-making at the program level. This holistic approach enables administrators to contextualize the performance of individual programs within the broader institutional framework, fostering a more informed and strategic approach to academic planning and resource allocation.

Furthermore, starting with a review of the academic portfolio promotes transparency, accountability, and equity within the institution. It allows for an inclusive assessment process that considers the diverse needs, perspectives, and contributions of various academic departments, disciplines, and stakeholders.

Categorizing your programs

The first step is to categorize programs based on a national view of program size and growth trends. This analysis provides a snapshot of the program mix to identify individual programs for further analysis.

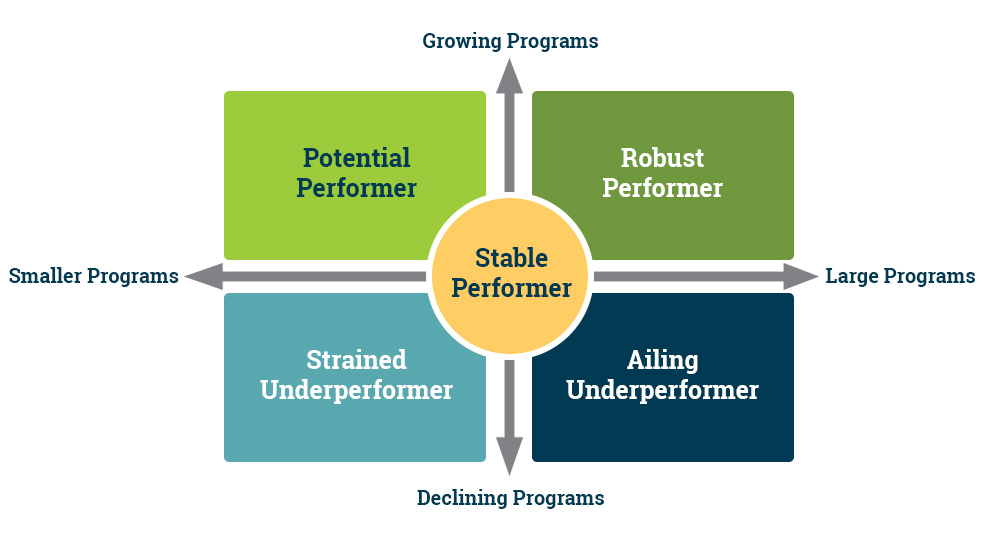

Figure 1: Portfolio Growth Segments

Here’s how we define growth segments:

- Robust Performer: Large and growing programs, considered good prospects for driving growth

- Potential Performer: Small but growing programs that have the potential to become robust if they can scale

- Stable Performer: Often large, commoditized legacy programs with stagnant growth

- Strained Underperformer: Small programs with declining enrollment where growth is limited

- Ailing Performer: Large programs with declining enrollment, determine whether a program refresh may turn the dial

Institutions should strive to achieve a balanced portfolio that prioritizes segments with growth and volume (Robust and Stable). Forward-looking schools dedicate some budget and resources to testing emerging programs (Potential). Strained and Ailing programs should be limited to those deeply aligned to the institution’s mission or a strong regional need.

The table below is an example of an institution’s portfolio review showing how its programs align with these growth segments and institutional data: conferrals, the 1-year growth trend, and 5-year growth trend. It illustrates the right mix of growth segments in a nicely balanced portfolio.

Next steps for portfolio management

Once you’ve completed this assessment, you have powerful data to inform strategic planning. The resulting categories highlight opportunities for better managing your portfolio and suggesting areas for potential shifts in budget, scaling up, or additional data analysis. For example, begin by further investigating programs classified as Robust Performers. Optimizing these programs typically provides a relatively quick return on investment.

- Robust Performers: Maintain strength in this segment and increase market share with ongoing investment.

- Potential Performers: Identify specific programs with realistic growth potential based on regional market factors.

- Stable Performers: Analyze programs to determine alignment with institutional priorities and streamline those misaligned. Innovative approaches are required to maintain market share.

- Strained Underperformers: Seek to “right size” number of programs with conferrals and divest in those without growth potential.

- Ailing Underperformers: Assess future viability of programs in decline and shift resources to Robust Performers.

Recommendations for the most meaningful results

The point of a portfolio review is to look at the holistic picture of your program offerings. Often the best way to achieve this data-driven assessment is to partner with an objective third party or identify a neutral internal party who is able to review data from multiple angles beyond academics.

The next article in this series will offer recommendations for using internal and external data for individual program evaluation. In the meantime, contact us to discuss how we can help you conduct a comprehensive portfolio review.

Innovation Starts Here

Higher ed is evolving — don’t get left behind. Explore how Collegis can help your institution thrive.

Employers want to partner with external providers to upskill and reskill their employees — presenting an opportunity for higher ed institutions to grow revenue by creating programs for employers. Our recent research with UPCEA found that from 2022 to 2023, companies partnering with external organizations to provide employee training/professional development increased 26%.

Challenges for higher education institutions

Higher ed is quickly losing these opportunities to private providers like Coursera and LinkedIn Learning. While partnerships with professional organizations and private providers rose year over year, partnerships with higher ed institutions fell. Schools need to aggressively align programs and processes with market demand and employer partnerships, or the market will go elsewhere.

The best way to take advantage of these opportunities is to play to your school’s strengths, prioritize program growth, and avoid overextending your resources. Consider using existing courses in high-demand areas to create online certificates and pathways to stack certificates into degree programs.

Top graduate certificate programs for 2024

Here’s a list of graduate certificate programs with the best growth potential (according to national conferral volume and growth). Are there any programs your school could develop to take advantage of this growing need?

Business

- Business Administration and Management

- Organizational Leadership

- Entrepreneurship

Education

- Teacher Education and Professional Development, Specific Levels and Methods, Other

- Special Education and Teaching, General

- Teaching English as a Second or Foreign Language/ESL Language Instructor

Healthcare/Nursing

- Psychiatric/Mental Health Nurse

- Family Practice Nurse

- Registered Nursing

Multidisciplinary

- Sustainability Studies

- Data Analytics, General

- Business Analytics

Science

- Epidemiology

- Natural Resources Management and Policy

- Biology/Biological Sciences, General

Social and Psychological Sciences

- Applied Behavior Analysis

- Geographic Information Science and Cartography

- Criminal Justice/Safety Studies

Technology

- Computer Systems Networking and Telecommunications

- Computer Programming/Programmer, General

- Computer and Information Sciences, General

Partnering with employers for program growth

After determining the most in-demand certificates for your school, partnering with employers to design the curriculum and develop enrollment pathways can help scale enrollments. Collegis can help you analyze your regional competition and the skills demanded most by local employers to develop the right programs for your market, support employer partnerships, and develop custom strategies for growth and differentiation.

Understanding Employer Perceptions: The Collegis-UPCEA 2024 report

Our new report “Unveiling the Employer’s View: An Employer-Centric Approach to Higher Education Partnerships” reveals what employers want and how to approach them. We’ll be here to help you get started.

Innovation Starts Here

Higher ed is evolving — don’t get left behind. Explore how Collegis can help your institution thrive.

How Spelman Expanded Reach to Working Adults

Like many colleges and universities today, Spelman was faced with the challenge of generating more revenue, particularly to help decrease the amount of debt its students graduate with. To begin combatting this challenge, the college ventured into online learning with summer courses that students could use to get ahead or catch up.

Keen interest in these courses prompted the college to leverage this model for a wider adult learner audience than their core population of women of color, and they scaled quickly:

In January 2022, eSpelman launched three courses and 49 learners. In 2023, enrollments rose to 1,300 learners. Today, eSpelman works with 19 corporate partners.

Collegis plays an integral role in faculty training and program planning for continued growth. Download “Expanding Vision to Reach Adult Learner Market” to learn how their marketing strategy, a partnership with Guild and alumni support contribute to eSpelman’s success.

Download Now

Transform Challenges Into Opportunities

Facing challenges in enrollment, retention, or tech integration? Seeking growth in new markets? Our strategic insights pave a clear path for overcoming obstacles and driving success in higher education.

Unlock the transformative potential within your institution – partner with us to turn today’s roadblocks into tomorrow’s achievements. Let’s chat.